The new accounting principle OIC 34 Revenues

On 19 April 2023, the Italian Accounting Body (“OIC”) published the accounting standard OIC 34 Revenues, which aims to indicate the accounting methodologies relating to the various issues that have arisen over the years regarding sales transactions and introduces important innovations with reference to accounting reporting.

When is OIC 34 applicable?

The new rules relating to revenue recognition will be applicable starting from 1 January 2024.

Any effects deriving from the application of OIC 34 must be detected according to the provisions of OIC 29; moreover, a simplified retrospective application is permitted with the adjustment of only the opening balance of the current financial year's equity rather than the comparative data.

The OIC 34 principle also allows the prospective application of the new rules, which will therefore only have effect with reference to sales contracts stipulated starting from the beginning of the first financial year of application of the accounting principle.

The choice of methodologies that do not provide for an adjustment of the data from the previous financial statements could lead to a non-comparability of the same data and therefore a difficult reading and understanding of the 2024 financial statements, as well as potentially critical issues in the operational and accounting management of the contracts stipulated in previous years.

What are the main innovations?

The key-factors of OIC 34 are represented by:

- Introduction of a new accounting framework for revenues, which replaces the references contained in accounting standard OIC 15 (credits)

- Scope of application: revenues from transactions with commercial purposes and/or sales, with the exclusion of revenues from contract work in progress which will continue to be accounted for pursuant to OIC 23;

- Separation of different services included in a contract for the purposes of their accounting.

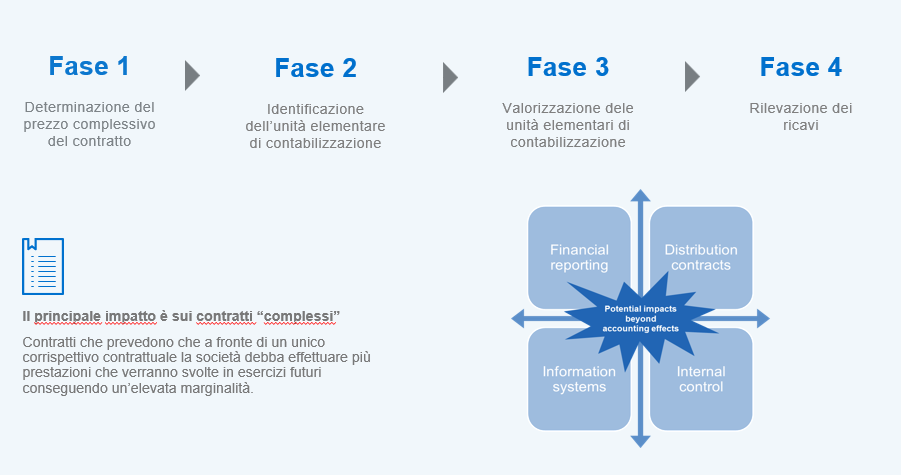

A 4-step detection

The approach foreseen for the new accounting treatment of revenues is developed in the following phases:

The first step of the revenue recognition process involves the estimate of the contractual consideration, taking into consideration any variable considerations such as discounts, bonuses, penalties, to be accounted for as a reduction in revenues on the basis of the best possible estimate of the consideration taking into account historical experience and /o statistical processing, financial components, non-cash consideration, amounts payable by customers.

The second step requires identifying the elementary accounting units included in the contract: the goods/services represent obligations to be accounted for separately if:

- the customer can use and reach benefits from the individual good/service separately and

- the obligation to transfer the good/service to the customer is separately identifiable from the other obligations included in the contract.

After determining the contract price and what are the individual elementary accounting units, we move on to valorize each of them by allocating the overall price of the contract to each identified "performance obligation".

Finally, revenue recognition will take place:

- for goods, when the substantial transfer of the risks and benefits connected to the sale has occurred (on the basis of both qualitative and quantitative elements, i.e. when the company will have transferred to the counterparty the ability to decide on the use of the good and to obtain the related definitive benefits (intended as the possible cash flows that can be obtained directly or indirectly from the asset);

- with regards to the provision of services, the related revenues will be recognized in the income statement based on the state of progress provided that the agreement between the parties provides that the right to the consideration accrues as the service is performed and that the The amount of the relevant revenue can be measured reliably. Otherwise, the revenue for the service provided will be recorded in the income statement when the service has been definitively completed.

Does OIC 34 regulate specific cases?

The accounting standard also establishes application rules regarding particular cases such as:

- Combination of contracts

- Risk of return

- Guarantees

- Customer loyalty policies (competitions,…)

- Role of «principal» or «agent»

- Bill and hold

- Licensing Agreements

- Contractual modifications

- Repurchase options or obbligations

- Costs that can be capitalized

What effects are expected from the application of OIC 34 and which sectors are most affected?

The impacts deriving from the application of OIC 34 may lead to a reduction in revenues and main indices such as EBIT and EBITDA, with potentially significant effects in sectors such as:

a) Consumer products

b) Retail

c) Industrial products

d) Utilities (electricity, gas)

e) Energy (e.g. gas extraction)

f) Software

Does the application of OIC 34 only have accounting effects?

From all of the above, it follows that the application of the new OIC 34 standard requires a focus in relation to the accounting effects, financial statement disclosures and the choice of the transition method.

But not only…. It requires greater communication between company functions and can impact information and communication systems, the review and structuring of contracts and related conditions or practices relating to the sales cycle.

It is important to proceed now with the definition and implementation of the process for compliance with the new principle, starting from understanding the standard, mapping existing contracts and simulating the effects deriving from the application of OIC 34 in order to grasp the different needs and opportunities.

How can Mazars help you in this process?

Mazars can provide you with assistance in defining and implementing the process for the transition to the new OIC 34 standard, also guaranteeing the adherence of your company's organisational, administrative and accounting structures to best practices through:

- training focused on the most impacted budget areas and workshops dedicated to the various company functions involved (finance, legal, sales function,...);

- gap analysis between the current accounting policy adopted regarding the recognition of revenues and the accounting methodology envisaged by OIC 34; this analysis, which will also include the legal aspects, will be carried out through the critical reading of the main contracts, with the support of a specific tool implemented by Mazars and adaptable to specific company needs;

- assistance in reviewing contractual conditions;

- focus on the most significant potential aspects deriving from the application of OIC 34, including tax impacts, financial statement disclosures and the transition method;

- evaluation of the impact of the new standard on the financial statements as a whole and on areas not strictly accounting (economic-financial planning; treasury management,...);

- evaluation of the impacts on your IT system.